LIC Bima Shree Plan 848 is a money back plan with Guaranteed Addition feature. This plan will be available from 16th March 2018. Whether can we buy LIC Bima Shree Plan 848? Let us see it�s features and benefits in detail.

It is a non-linked, with profits, limited premium payment money back plan. This plan offers the minimum sum assured of Rs.10 lakh and as per LIC�s claim designed to target the HNIs.

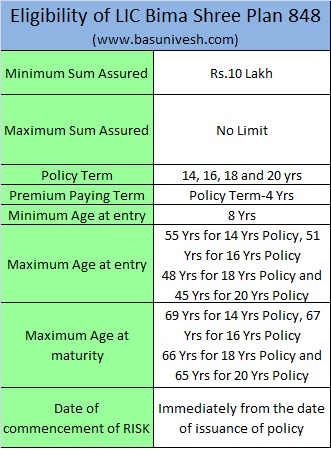

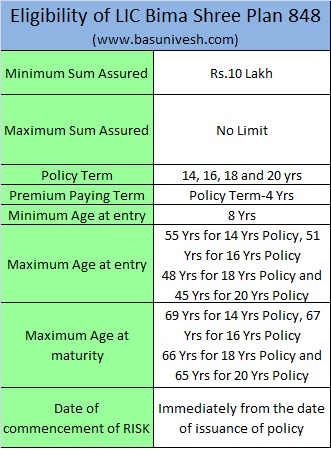

Eligibility of LIC Bima Shree Plan 848

Features of LIC Bima Shree Plan 848

-

Unlike the typical traditional plans of LIC, this plan will be eligible for paid-up immediately after the completion of 2 years. For all other policies of LIC, paid up feature will be applicable if you paid the premium for at least 3 years.

-

As the policy is eligible for paid up after 2 years, you are eligible to surrender the policy immediately after the 2nd year completion.

-

You can avail the loan after a year of the policy.

-

This plan offers the riders like Accidental Death and Disability Benefit, Accident Benefit, New Term Assurance Rider, Critical Illness rider and premium waiver rider. However, the policyholder can opt either Accidental Death and Disability Benefit or Accident Benefit. Hence, one can avail the maximum of 4 riders in this plan.

-

You can pay the premium yearly, half-yearly, quarterly or monthly.

Benefits of LIC Bima Shree Plan 848

Guaranteed Addition under LIC Bima Shree Plan 848

This plan offers the guaranteed addition. For the first 5 years, the guaranteed addition will be Rs.50 per Rs.1,000 Sum Assured.

From 6th year onward to till POLICY PREMIUM PAYING TERM, this plan offers the guaranteed addition of Rs.55 per Rs.1,000 Sum Assured.

Along with this, this plan is eligible for Loyalty Addition also (which is one-time payment either at maturity or death of the policyholder).

Death Benefits of LIC Bima Shree Plan 848

There are two conditions to pay the death benefits under this plan and they are as below.

-

a) Death during the first 5 years of the policy period

If death occurs during the first 5 years of the policy period, then the benefit is as below.

Sum Assured on death+Guaranteed Addition at Rs.50 per Rs.1,000 Sum Assured.

-

b) Death from 6th year to policy maturity date

Sum Assured on death+Guaranteed Addition (for first 5 years Guaranteed Addition will be at Rs.50 per Rs.1,000 Sum Assured and from 6th year onward it will be Rs.55 per Rs.1,000 Sum Assured)+Loyalty Addition.

Survival benefits of LIC Bima Shree Plan 848

If policyholder survives to each of the specified duration during the policy term, a fixed % of Basic Sum Assured will be payable. This fixed % is as below.

-

For 14 Yrs Policy-30% of Basic Sum Assured on each 10th and 12th policy year.

-

For 16 Yrs Policy-35% of Basic Sum Assured on each 12th and 14th policy year.

-

For 18 Yrs Policy-40% of Basic Sum Assured on each 14th and 16th policy year.

-

For 20 Yrs Policy-45% of Basic Sum Assured on each 16th and 18th policy year.

Maturity benefits of LIC Bima Shree Plan 848

If policyholder survives up to the policy period, then he will receive the below benefits.

-

For 14 Yrs Policy-40% of Basic Sum Assured+Guaranteed Addition+Loyalty Addition.

-

For 16 Yrs Policy-30% of Basic Sum Assured+Guaranteed Addition+Loyalty Addition.

-

For 18 Yrs Policy-20% of Basic Sum Assured+Guaranteed Addition+Loyalty Addition.

-

For 20 Yrs Policy-10% of Basic Sum Assured+Guaranteed Addition+Loyalty Addition.

Premium Calculator